Analysis of New Zealand Adult Escort Websites: A Competitive Landscape Review

I. Executive Summary

The New Zealand adult escort market operates within a distinctive regulatory framework, characterized by the decriminalization of sex work under the Prostitution Reform Act 2003. This legal stance, while progressive, imposes specific advertising restrictions that significantly shape the industry's digital landscape. Online platforms have emerged as primary facilitators, effectively serving as digital classifieds in an environment where traditional broad advertising channels are largely prohibited. This report examines the competitive dynamics within this market, focusing on direct escort directory rivals and excluding the top eight general adult content sites. It highlights the critical role of search engine optimization (SEO), trust-building mechanisms, and diverse monetization strategies.

The market exhibits a fragmented structure, encompassing traditional classifieds, established online directories, and innovative hybrid social platforms. Each type of platform navigates the regulatory nuances and consumer expectations differently. The analysis positions MyAngelsEscorts.com and EscortLocate.co.nz within this context. MyAngelsEscorts.com distinguishes itself through a focus on paid promotional features and competitive pricing for providers, aiming to maximize visibility for its advertisers. Conversely, EscortLocate.co.nz adopts a strategy of offering free listings, primarily focusing on broad reach and market penetration. The varying approaches to monetization and user experience across these platforms underscore the evolving demands of both service providers and clients in this sensitive industry.

II. New Zealand Adult Services Market Context

Legal and Regulatory Framework for Sex Work and Advertising in NZ

New Zealand's approach to sex work is unique, defined by the Prostitution Reform Act 2003. This legislation decriminalized various aspects of sex work, including prostitution, brothel-keeping, and street solicitation, rendering them "not illegal" but rather "restricted activities". This legislative choice is distinct from full legalization, which would imply complete integration into standard business practices without specific limitations. A key aspect of this framework is the continued criminalization of coercion of sex workers.

Advertising for commercial sexual services faces significant limitations. General advertising on radio, television, or in public cinemas is explicitly prohibited. The primary exception is for classified advertisements published in newspapers or periodicals. Local governments retain the authority to implement bylaws concerning zoning and advertising, but these cannot outright ban sex work. This regulatory environment compels the industry to seek alternative, compliant avenues for promotion. Furthermore, sex workers in New Zealand benefit from occupational health and safety guidelines, and decriminalization has been associated with positive public health outcomes, such as reduced rates of STIs and HIV, and increased adoption of safe sex practices. However, individuals on temporary visas are prohibited from engaging in sex work, and investment in or immigration for sex work is also disallowed. While Work and Income New Zealand acknowledges sex work as legitimate employment, it does not advertise related vacancies.

The specific legal provisions, particularly the allowance for "classified advertisements," create an inherent advantage for online directories. These platforms function as digital equivalents of traditional classifieds, enabling them to operate within the legal framework while circumventing broader advertising prohibitions. This regulatory landscape effectively channels the adult services industry towards online marketplaces, making search engine optimization (SEO) a paramount factor for visibility, as direct advertising avenues are constrained. The continued presence of social stigma and variations in local bylaws, despite decriminalization, emphasizes the need for online platforms to prioritize features that ensure user privacy, discretion, and a sense of security. Platforms that offer robust privacy controls, verification processes, and a discreet user experience are therefore more likely to attract and retain both providers and clients. The existence of occupational health and safety guidelines and support organizations like the New Zealand Prostitutes' Collective (NZPC) also presents an opportunity for platforms to offer more than just basic listings. By providing resources or information related to worker rights, health, or legal compliance, a platform can enhance its value proposition and attract a more professional and loyal provider base.

Digital Landscape and Online Adult Content Consumption Trends in NZ

New Zealand exhibits a highly digitally connected populace, with technology deeply embedded in daily life. A substantial 88.7% of the adult population (aged 18 and above) actively engaged with social media platforms at the beginning of 2025. Even individuals aged 50 and over spend an average of 5.3 hours per week connected to their devices, with 89% utilizing social media. This pervasive digital engagement highlights the internet as a primary channel for information, communication, and entertainment.

Mobile devices are the dominant medium for content consumption in New Zealand. This necessitates that online content, particularly for social media, is optimized for mobile viewing, favoring vertical video formats and graphics that are easily digestible on smaller screens. The broader adult content industry leverages diverse monetization strategies beyond traditional advertising. These include subscription-based models, pay-per-view (PPV) content, direct tipping and donations, sales of customized content, paid messaging, affiliate marketing, and exclusive memberships. Advertising revenue, particularly for large "tube" sites, remains a significant income stream, often complemented by affiliate marketing partnerships. User-Generated Content (UGC) platforms have become a predominant mode for the consumption and distribution of pornographic material online.

The high rates of mobile and social media usage in New Zealand dictate that a mobile-optimized website is a fundamental requirement for any online adult service platform. A dedicated mobile application, as offered by Foxygirls.co.nz , could provide a notable competitive advantage, enhancing user retention and engagement through a seamless experience. If the majority of the target audience interacts via mobile, a poorly optimized mobile interface would lead to high bounce rates. Investing in a truly fluid mobile experience, potentially through a native application, transforms from a beneficial addition to an essential component for competitive differentiation.

While escort directories have historically relied on listing fees, the broader adult content market's adoption of diverse monetization models presents substantial opportunities to increase average revenue per user (ARPU) from both clients and providers. This could involve introducing premium client features such as advanced search capabilities, direct messaging, or an ad-free experience, or enabling direct tipping mechanisms for escorts through the platform. This expansion of revenue streams would enhance profitability. Given the existing advertising restrictions on adult services, SEO and content marketing emerge as the most viable and critical strategies for driving organic traffic and client acquisition. Platforms that excel in SEO will naturally attract more users, and investing in high-quality, relevant content—even if not explicitly sexual, but related to topics like safety or etiquette—can significantly boost visibility in search engine rankings.

III. Competitive Landscape: NZ Escort Directories (Excluding Top 8 General Adult Sites)

The New Zealand adult escort directory market is characterized by a blend of traditional and modern platforms, each vying for visibility and user engagement. This section identifies key competitors and analyzes their core features, business models, and user experience strategies.

Identification of Key Competitors

The competitive landscape for New Zealand escort directories, excluding the top 8 general adult sites, primarily consists of the following:

- Traditional Classifieds:NZ Herald Classifieds: This platform offers an "Adult Entertainment" section, featuring numerous individual advertisements for escorts and massage services. Communication is primarily phone-based, and new ads are published daily, remaining visible for seven days. ListStuff.co.nz: This classifieds site includes an "Adult Section" under its "Personals" category, requiring users to confirm they are 18 years or older before viewing the content.

- Established Online Directories:Foxygirls.co.nz: Positioned as one of the "oldest, most trusted and largest escort directories in New Zealand". It offers a comprehensive catalogue of providers, including luxury companions, escorts of various genders (female, male, trans/shemale), independent services, agency affiliations, dominatrixes, masseuses, massage parlours, brothels, and strip clubs. Foxygirls.co.nz notably claims to be the "New Zealand first mobile app" in this sector. Yellow.co.nz (Directory Listings): As a general business directory, Yellow.co.nz includes categories for "Escort Agencies" and "Brothels." Listings typically provide basic contact information for businesses such as Paris, Dark Angels High-Class Escort Agency, Alex & Mark, and Club Rendezvous.

- Emerging Hybrid/Social Platforms:Oni.nz: This platform is designed as an "adult social media platform" for adult New Zealanders. It integrates "Erotic Listings" (featuring independent escorts, agencies, and adult entertainers), "Local Businesses" (adult stores, agencies, service providers), and a "Special Requests" feature for clients to connect with providers for specific desires. Oni.nz promotes a "safer, uncensored" experience with optional member verification and community-focused features.

The evolution of the market from simple phone-based classifieds to sophisticated online directories and now hybrid social platforms is evident. This progression indicates a growing expectation among users for more advanced features and interactive experiences. The emphasis on location-based search and "verified" profiles across many of these platforms is crucial for both client convenience and building trust within a sensitive service industry. Platforms that effectively combine local search capabilities with robust verification processes are likely to gain a competitive edge.

Analysis of Core Features and Service Offerings

The leading platforms in the New Zealand escort directory market offer a range of features designed to cater to both providers and clients.

- MyAngelsEscorts.com :Core Offering: Functions as an online escort directory for New Zealand and Australia, connecting clients with escorts and offering advertising tools for providers. Diverse Service Listings: Supports advertising for a wide array of specific services, including incall/outcall, sensual massage, BDSM, GFE (Girlfriend Experience), fetish, balls sucking, deep throat, kissing/touching, and sexy lingerie. This detailed categorization helps clients find services tailored to their preferences. Provider Promotional Features: Offers a suite of tools to enhance provider visibility:BOOST Feature: Elevates profiles to the top of listings. "Available Now" Badge: Indicates immediate availability for bookings, designed to attract quick client engagement. VIP Status: Claims an 800% increase in views compared to standard listings, with prominent placement at the top of the page and exclusive promotional options. Free Ad Daily Boost: A complimentary daily boost to maintain ad visibility. Profile Management: Provides tools for providers to manage profile details and track ad status efficiently. Verification: Offers a "Verified Badge" process to build client trust, though it explicitly states this does not guarantee service quality or endorsement. Privacy: Emphasizes strict adherence to data protection rules. Client Search: Includes a "Nearby Escorts" feature to facilitate location-based searches.

- EscortLocate.co.nz :Free Ad Posting: A primary feature, encouraging high-quality content and photo verification from advertisers. Detailed Listings: Provides comprehensive listings for verified escorts, adult entertainers, and sensual massage services across major New Zealand cities. Search and Discovery: Features "Latest Escorts" and "Popular Escorts" sections, along with location-based search options. Structured Onboarding: Offers a clear, step-by-step process for ad creation, including basic information, location, photos, description, rates, and a mandatory verification photo.

- Foxygirls.co.nz :Comprehensive Catalogue: Lists a wide range of adult services, including luxury companions, male, female, and trans escorts, independent and agency services, dominatrixes, masseuses, massage parlours, brothels, and strip clubs. Mobile App: Promotes itself as having a "New Zealand first mobile app" for discreet browsing and searching. Direct Contact: Facilitates direct communication between clients and escorts.

- Oni.nz :Hybrid Model: Combines "Erotic Listings" with social media functionalities, aiming to foster a community of "stars, providers, fans, followers, customers, and clients". "Special Requests" Feature: Allows clients to connect with providers for specific, customized desires. Optional Verification: Offers optional member verification to enhance trust within its social environment. Uncensored Experience: Emphasizes "expression without fear" and an "uncensored, unfiltered experience" to attract users seeking fewer content restrictions.

The extensive and clearly defined promotional features offered by MyAngelsEscorts.com, such as BOOST, VIP Status, and Daily Boost, indicate a sophisticated approach to monetizing its provider base by selling enhanced visibility. The claim of an 800% view increase for VIP status represents a strong, quantifiable value proposition for escorts, demonstrating an understanding of what providers in this competitive market prioritize: exposure. By offering tiered visibility, MyAngelsEscorts.com directly links payment to tangible benefits for escorts, driving revenue.

The presence of a "Verified Badge" on MyAngelsEscorts.com, coupled with a disclaimer that it "does not guarantee service quality or endorsement" , illustrates a strategic attempt to build user trust while simultaneously limiting the platform's liability for the services provided. This approach seeks to address user concerns about authenticity while navigating the legal and operational complexities of content moderation in a sensitive industry. This balance is critical for the platform's reputation and legal standing.

EscortLocate.co.nz's primary reliance on a free listing model is effective for rapid market penetration and building a large database of providers. However, this model may limit its revenue per provider compared to platforms offering premium features. This strategic choice highlights a trade-off: maximizing provider volume versus maximizing revenue per provider. EscortLocate.co.nz could potentially enhance its monetization by introducing tiered premium features for providers, such as featured listings or more extensive profile options, drawing lessons from MyAngelsEscorts.com and the broader directory market.

Oni.nz's "Special Requests" feature and its social media focus point to a growing demand for more customized and interactive experiences beyond standard directory listings. This approach suggests a market segment that values personalized interactions and a sense of community. Integrating such features could create new revenue streams and increase user engagement, moving the platform beyond a simple transactional model to a more engaging ecosystem.

Business Models and Monetization Strategies

The monetization strategies employed by New Zealand escort directories vary, reflecting different approaches to market capture and revenue generation.

- MyAngelsEscorts.com:Freemium/Paid Promotion: This platform operates as an advertising hub, with its primary revenue derived from paid promotional features for escorts. These include the BOOST feature, "Available Now" badge, VIP Status, and a Free Ad Daily Boost. Cost Leadership: MyAngelsEscorts.com asserts that its advertising costs are "multiple times lower" than those of its main competitors in New Zealand and Australia , aiming to attract a large volume of providers. Traffic Generation: The platform heavily relies on achieving high Google rankings for adult-related keywords, employing professional SEO strategies and a dedicated marketing team to drive organic traffic. It reports over 31,520 unique users daily and more than 984,000 hits monthly. Payment Options: A wide array of payment methods are accepted, including credit cards (Mastercard), Prezzy card, Visa debit card, Union Pay card, and online bank transfers.

- EscortLocate.co.nz:Free Listing Model: This platform primarily offers free ad posting for providers. The provided information does not explicitly mention premium features or paid upgrades for escorts. Platform Role: EscortLocate.co.nz explicitly states its function as a directory, clarifying that it does not participate in or control the services offered by its advertisers.

- Foxygirls.co.nz:Advertising Model: The platform's description implies a paid advertising model for a broad range of adult businesses, including escorts, agencies, brothels, and other establishments, without imposing exclusivity rules on advertisers.

- Oni.nz:Freemium/Paid Listings: Standard membership on Oni.nz is free, but advertising listings for providers constitute a paid service.

- General Adult Website Monetization Trends:Advertising: Common models include Pay-Per-Click (PPC), Cost-Per-Mille (CPM), Cost-Per-Action (CPA), and pop-under ads. Affiliate Marketing: Many platforms generate revenue by partnering with adult brands, cam sites, or dating platforms, earning commissions from referrals. Subscriptions/Paywalls: Offering premium content access for a recurring fee is a prevalent model. Tipping/Donations: Direct financial support from users to performers is common, particularly during live streams. Lead Generation: Some directories monetize by charging businesses a fee per high-quality lead generated through their platform.

MyAngelsEscorts.com's strategy combines a cost-leadership approach—claiming "lowest cost" advertising—with a robust freemium model for providers, offering paid visibility features. This hybrid strategy allows the platform to attract a large volume of providers through a low entry barrier, while simultaneously generating substantial revenue by upselling enhanced exposure to those seeking greater visibility. This balanced approach is particularly effective in a competitive market.

The free listing model employed by EscortLocate.co.nz, while effective for rapid market penetration and building a large database of providers, represents a significant missed opportunity for direct revenue generation from its core service. While "free" attracts users, it does not inherently generate income. EscortLocate.co.nz could enhance its sustainability by introducing tiered premium features for providers, such as featured listings, increased photo allowances, or direct messaging capabilities, drawing inspiration from MyAngelsEscorts.com and broader directory monetization strategies.

The comprehensive range of payment options offered by MyAngelsEscorts.com, including various credit cards and online bank transfers , highlights a critical operational strength and a competitive advantage in the adult industry. This sector often faces challenges with traditional payment processors. MyAngelsEscorts.com's successful navigation of these hurdles provides convenience to providers, reduces friction in its business model, and can serve as a key differentiator.

User Experience (UX) and Community Engagement

User experience and community engagement are pivotal for the success of online platforms in the adult services sector, influencing both client satisfaction and provider retention.

- MyAngelsEscorts.com:Client UX: The platform aims for "ease of booking and instant connection," presenting itself as a "glamorous professional escort based website" that displays "updated escorts and their sexual service interests' information". This suggests a focus on a high-end aesthetic and efficient service discovery. Escort UX: The platform emphasizes "effortless profile management," describing the self-management process as "simple and stress-free," with "quick and simple" ad posting. It also provides tips and strategies to help providers enhance their profiles for better visibility and client engagement. Transparency/Disclaimer: The website requires users to confirm they are 18 years or older and explicitly states that it hosts unverified adult content, disclaiming responsibility for the ads or the behavior of advertisers.

- EscortLocate.co.nz:Overall UX Goal: Aims to be a "professional, secure, and easy to use platform" offering a "more refined and easier way of searching" for adult service providers. Client Discovery: Features sections for "Latest Escorts" and "Popular Escorts" to facilitate client discovery. Provider Onboarding: Provides a clear, step-by-step process for creating an ad profile, which includes mandatory photo verification and administrative approval.

- Foxygirls.co.nz:Navigation: Promotes an "easy to navigate" website. Mobile Experience: Highlights its "New Zealand first mobile app" for discreet browsing, indicating an understanding of mobile-first user behavior.

- Oni.nz:Community Focus: Emphasizes a "safer, uncensored social media experience" where adult New Zealanders can "connect, share, and engage." It promotes "expression without fear" and offers optional member verification to foster a sense of security and community. Interactive Features: Incorporates social features and a "Special Requests" function, suggesting a move towards more interactive user experiences.

- General UX Trends in Adult Platforms: Across the broader adult content landscape, key user experience elements include user-friendly interfaces, detailed filtering options, robust privacy and security measures (such as encryption and anonymity), and features that support community interaction like forums and chat rooms.

The contrasting UX approaches between MyAngelsEscorts.com and EscortLocate.co.nz are notable. MyAngelsEscorts.com's emphasis on a "glamorous" image suggests a focus on aesthetic appeal and a potentially more premium user base. In contrast, EscortLocate.co.nz's focus on a "refined" and "easy" search experience points to a more utilitarian design, prioritizing efficiency and straightforward navigation. Both are valid design philosophies, and their effectiveness depends on their specific target audiences.

The encouragement of user-generated content and the provision of verification features by platforms like MyAngelsEscorts.com, EscortLocate.co.nz, and Oni.nz are crucial for content freshness and building trust. However, MyAngelsEscorts.com's explicit disclaimer regarding responsibility for "unverified adult content" or "behaviors" underscores the inherent challenges of content moderation and liability management in this industry. This transparency, while legally prudent, could be a point of differentiation if competitors offer stricter vetting or guarantees, similar to the 24/7 moderation found on platforms like Emerald Chat.

Compared to emerging hybrid platforms like Oni.nz, which integrate social media features and "Special Requests," MyAngelsEscorts.com and EscortLocate.co.nz appear to be more traditional directories. This suggests a potential area for growth by incorporating more interactive features such as forums, direct chat between clients and providers (beyond just contact information), or social feeds. Such additions could increase user stickiness and time spent on the platform, transforming them from simple "find-and-leave" models into more engaging ecosystems.

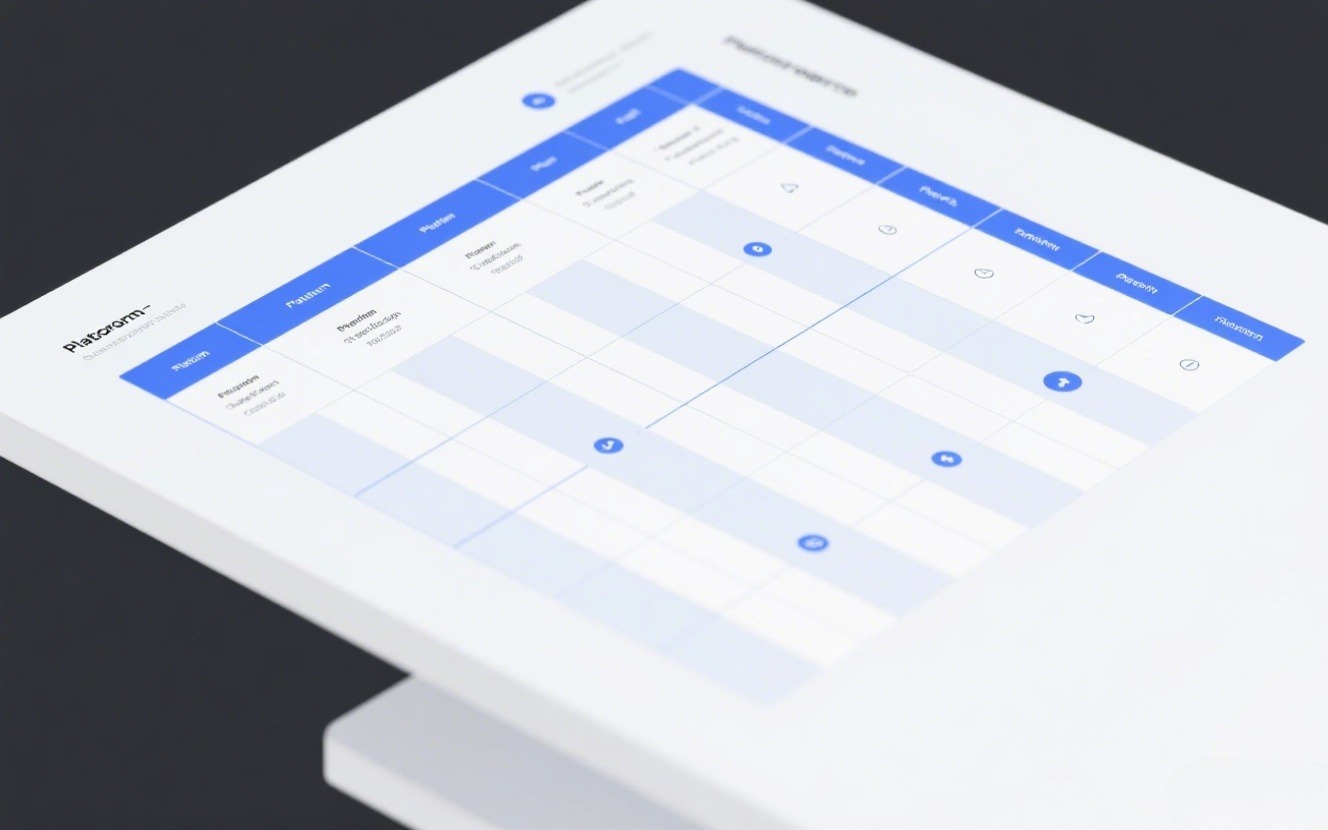

Key Table 1: Key Features Comparison of Leading NZ Escort Directories

| Feature/Metric | MyAngelsEscorts.com | EscortLocate.co.nz | Foxygirls.co.nz | Oni.nz | NZ Herald Classifieds |

| Primary Business Model | Freemium (Paid Promotion) | Free Listings | Paid Advertising | Freemium (Paid Listings) | Classified Ads |

| Reported Monthly Traffic/Reach | >984k hits | Not specified | "Largest" | Not specified | Daily ads |

| Mobile App | No (Mobile-optimized website) | No (Mobile-optimized website) | Yes (NZ first mobile app) | No (Mobile-optimized website) | No |

| Provider Verification | Verified Badge | Photo Verification | Not specified | Optional Member Verification | N/A |

| Provider Promotional Features | BOOST, VIP (800% views), Daily Boost | None explicit | Not specified | Paid Listings | N/A |

| Cost for Providers | Claims "lowest cost" | Free listings | Not specified | Paid listings | Paid classifieds |

| Service Categories Detail | High (GFE, BDSM, etc.) | Medium (Verified, Entertainers, Massage) | High (Dominatrix, Brothels, etc.) | Medium (Escort, Gigolo, Business, OnlyFans) | Basic (Massage, Full Service) |

| Community Features | Limited/None | Limited/None | Limited/None | Yes (Social media platform, groups, special requests) | None |

| Privacy/Security Emphasis | Strict data protection | Professional, secure platform | Not specified | Safer, uncensored, expression without fear | N/A |

Key Table 2: Monetization Models of NZ Escort Platforms

| Platform | Primary Revenue Model | Specific Monetization Features | Additional Revenue Streams (Inferred/Known) |

| MyAngelsEscorts.com | Provider Paid Promotion | BOOST feature, "Available Now" badge, VIP Status, Free Ad Daily Boost | (Inferred: Potential for affiliate marketing, future client premium features) |

| EscortLocate.co.nz | Free Listings | None explicitly stated for monetization | (Inferred: Display advertising, future premium provider/client features, lead generation) |

| Foxygirls.co.nz | Provider Paid Advertising | Advertising open to various adult businesses | (Inferred: Display advertising, potential for premium features) |

| Oni.nz | Paid Listings / Freemium | Paid ad listings for providers | (Inferred: Affiliate marketing, potential for premium social features) |

| NZ Herald Classifieds | Paid Classified Ads | Per-ad fee for print classifieds | (Inferred: Broader newspaper advertising) |

IV. In-Depth Analysis: MyAngelsEscorts.com

Services and Features Overview

MyAngelsEscorts.com operates as a comprehensive online escort directory spanning both New Zealand and Australia. Its fundamental purpose is to facilitate connections between clients seeking escort services and providers offering them, while simultaneously furnishing robust advertising tools for escorts. The platform supports a diverse range of services, allowing providers to advertise incall and outcall options, sensual massage, BDSM, GFE (Girlfriend Experience), fetish services, balls sucking, deep throat, kissing and touching, and sexy lingerie. This extensive categorization is designed to cater to a wide spectrum of client preferences and allows providers to detail their specific offerings.

A significant aspect of MyAngelsEscorts.com's offering lies in its suite of promotional features tailored for providers. The "BOOST" feature enables escorts to elevate their profiles to the top of listings, thereby increasing their visibility. An "Available Now" badge can be added to signal immediate readiness for bookings, aiming to attract prompt client engagement. The "VIP Status" is a premium offering, claiming to deliver an impressive 800% more views than standard listings, accompanied by prominent placement at the top of the page and exclusive promotional opportunities. Additionally, the platform provides a "Free Ad Daily Boost," a complimentary feature allowing advertisers to boost their ad once daily to maintain visibility.

For providers, the platform emphasizes "effortless profile management," offering tools that enable them to control every detail of their profile and track the status of their advertisements directly from their account. This focus on user-friendly self-management is intended to make the advertising process simple and stress-free. MyAngelsEscorts.com also offers a "Verified Badge" obtained through a verification process, designed to build trust with potential clients. However, it is explicitly stated that this badge "does not guarantee service quality or endorsement". The platform also underscores its commitment to privacy, adhering strictly to data protection rules to ensure personal information is not shared with third parties without consent. For clients, a "Nearby Escorts" search feature is available, enabling location-based searches that help local profiles gain maximum views in this highly trafficked category.

The extensive and clearly defined promotional features, such as BOOST, VIP Status, and Daily Boost, demonstrate that MyAngelsEscorts.com has developed a sophisticated strategy for generating revenue from its provider base by selling enhanced visibility. The claim of an 800% increase in views for VIP status represents a strong, quantifiable value proposition for escorts. This approach reflects an understanding that in a competitive market, providers are willing to pay for increased exposure, creating a direct link between payment and tangible benefits.

The inclusion of a "Verified Badge" alongside a disclaimer that it "does not guarantee service quality or endorsement" reveals a deliberate strategy to balance building user trust with mitigating the platform's liability for the services provided. This approach attempts to address client concerns about authenticity while navigating the legal and operational complexities of content moderation in a sensitive industry. This balance is crucial for maintaining the platform's reputation and managing legal exposure.

Business Model and Monetization

MyAngelsEscorts.com operates primarily as an advertising platform and escort directory, with a core mission to become a professional escort directory in New Zealand and Australia offering the lowest advertising costs. Its business model is centered on maximizing visibility for advertisers through a hybrid approach that combines cost leadership with a freemium offering for promotional features.

The platform's revenue is predominantly generated from the sale of paid promotional features to escorts. These include the "BOOST" feature, the "Available Now" badge, and "VIP Status," which provides significantly increased exposure. Additionally, a "Free Ad Daily Boost" is offered, encouraging regular engagement and maintaining ad visibility. This tiered approach allows providers to choose their level of visibility based on their budget and desired reach.

MyAngelsEscorts.com claims its advertising prices are "multiple times lower than our main competitors in New Zealand and Australia". This aggressive pricing strategy is designed to attract a large volume of providers, thereby increasing the overall size and attractiveness of its directory. The platform heavily invests in driving organic traffic, leveraging high Google rankings for adult-related keywords through professional SEO strategies and a dedicated marketing team. This focus on organic reach is particularly important given the advertising restrictions in the adult services sector. The platform reports a substantial audience, with over 31,520 unique users daily and more than 984,000 hits monthly, indicating a significant potential client base for its advertisers.

To facilitate transactions for providers, MyAngelsEscorts.com supports a variety of payment methods, including major credit cards (Credit Card, Mastercard, Visa Debit Card), Prezzy Card, Union Pay Card, and online bank transfers. This broad acceptance of payment options helps reduce friction for providers wishing to advertise their services.

MyAngelsEscorts.com's hybrid competitive strategy, combining a cost-leadership claim with a strong freemium model for providers, allows it to attract a large volume of users while simultaneously generating revenue through premium features. The claim of "lowest cost" is a direct competitive statement, aiming to capture market share. However, the platform's ability to upsell premium features means it is not solely reliant on a low-cost model, striking a balance between broad appeal and revenue generation per provider.

The diverse array of payment options offered by MyAngelsEscorts.com indicates a successful navigation of the often-complex landscape of payment processing in adult industries. This sector frequently encounters difficulties with traditional financial institutions and payment gateways. By providing multiple convenient payment methods, MyAngelsEscorts.com enhances the user experience for providers and establishes an operational strength that can serve as a significant competitive differentiator.

V. In-Depth Analysis: EscortLocate.co.nz

Services and Features Overview

EscortLocate.co.nz positions itself as an online directory specifically for adult services within New Zealand. The platform's core offering revolves around providing listings for verified escort ads, adult entertainers, and sensual massage services. It aims to serve as a comprehensive resource for clients seeking these services across major New Zealand cities, including Auckland, Wellington, and Christchurch, among others.

A key feature of EscortLocate.co.nz is its emphasis on detailed listings. These listings are designed to provide comprehensive information for adult service providers, including both verified independent escorts and established agencies. The platform encourages advertisers to provide high-quality content and requires photo verification, which is intended to build trust and enhance visibility for the listed profiles.

For clients, the website facilitates search and discovery of "distinctive and lawful escort offerings" and helps them find "most sought after companions". The site supports location-based searches, featuring navigation links for specific cities and regions across New Zealand, such as Auckland, Wellington, Christchurch, Hamilton, Tauranga, Northland, Central North Island, and South Island. This geographical segmentation aids clients in finding local providers. The platform also includes sections for "Latest Escorts" and "Popular Escorts" to assist users in discovering recently added or highly viewed services. For providers, the platform offers a structured, step-by-step process for creating an ad profile, encompassing basic information, location details, photo uploads, service descriptions, rates, and a mandatory verification photo. This process culminates in an administrative approval step before the advertisement goes live.

The mandatory photo verification and administrative approval process for providers on EscortLocate.co.nz suggests a focus on maintaining a baseline level of quality and authenticity within its directory. This approach is intended to enhance client trust by ensuring that listings are legitimate. However, the reliance on administrator approval could potentially introduce delays in the onboarding process for new providers.

The emphasis on "detailed listings" and a structured onboarding process for providers indicates a commitment to providing a clear and comprehensive user experience. This level of detail benefits both clients, who receive more information to make informed choices, and providers, who can present their services clearly. The requirement for a mandatory verification photo also serves as a mechanism to build trust, which is a critical factor in the adult services industry.

Business Model and Monetization

EscortLocate.co.nz operates as an online directory for adult services in New Zealand, with a distinct business model centered on offering free ad posting for providers. This "free listing" model is a primary characteristic of its approach, aiming to attract a broad base of service providers to populate its directory.

The platform's primary function is to serve as an advertising space where independent adult service providers and established agencies can list their services. Crucially, EscortLocate.co.nz explicitly states that it "does not participate in or control the services offered by the advertisers". This disclaimer clarifies its role as a facilitator rather than a direct participant in the provision of services.

Based on the available information, there is no explicit mention of premium features or paid upgrades for escorts on EscortLocate.co.nz. This suggests that its immediate revenue streams may not directly stem from provider payments for enhanced visibility, unlike other platforms that employ freemium models.

The free listing model employed by EscortLocate.co.nz is an effective strategy for rapid market penetration and building a large database of providers. However, this model, in its current apparent form, represents a significant missed opportunity for direct revenue generation from its core service. While offering free listings attracts a high volume of users, it does not inherently generate income from those listings.

EscortLocate.co.nz could potentially learn from the monetization strategies observed in the broader adult content market and by competitors like MyAngelsEscorts.com. By introducing tiered premium features for providers, such as options for featured listings, increased photo allowances, or direct messaging capabilities, the platform could monetize its growing user base more effectively. This shift would transform it from a purely volume-driven model to a more sustainable revenue-generating platform, potentially through display advertising or by offering lead generation services to providers for a fee.

User Experience (UX) and Community Engagement

EscortLocate.co.nz is designed with the goal of providing a "professional, secure, and easy to use platform". Its user experience aims to offer a "more refined and easier way of searching for adult service providers and clients". This focus on refinement and ease of use suggests a design philosophy that prioritizes straightforward navigation and efficient information retrieval for clients.

For clients, the platform facilitates discovery through dedicated sections like "Latest Escorts" and "Popular Escorts". These features help users quickly identify new additions to the directory or highly sought-after providers. The emphasis on location-based search, with clear navigation links for various New Zealand cities and regions, further enhances the client's ability to find relevant services efficiently. The website also provides options for users to sign in or post a free ad, indicating a clear call to action for both clients and potential providers.

For providers, the onboarding process for creating an ad profile is described as clear and step-by-step. This structured approach guides providers through entering basic information, specifying their location, uploading photos, detailing their services, setting rates, and submitting a mandatory verification photo. The requirement for a verification photo and subsequent administrative approval before an ad goes live is a key aspect of the provider experience, aiming to ensure legitimacy and build trust within the directory.

The UX design of EscortLocate.co.nz, with its emphasis on "refined" and "easy" searching , suggests a utilitarian approach that prioritizes efficiency and straightforward navigation. This contrasts with platforms that might focus on a more "glamorous" or interactive aesthetic. This difference in design philosophy reflects varying target user preferences and business objectives.

While EscortLocate.co.nz encourages user-generated content through its free listing model and implements photo verification , it appears to be a more traditional directory compared to emerging hybrid platforms like Oni.nz. This means it may be missing opportunities for deeper user engagement through community features. Integrating elements such as forums, direct chat functionalities between clients and providers (beyond just contact information), or social feeds could significantly increase user stickiness and time spent on the platform. Such enhancements would transform the platform from a simple "find-and-leave" model to a more interactive and engaging ecosystem, fostering a stronger sense of community among its users.

VI. Conclusions

The New Zealand adult escort market operates under a unique decriminalized legal framework that significantly influences its digital landscape. Advertising restrictions, particularly the prohibition of broad media advertising, have inadvertently propelled online directories into a central role, effectively making them the primary public-facing marketplace for the industry. This regulatory environment underscores the critical importance of SEO and direct digital marketing strategies for visibility and client acquisition.

Within this landscape, platforms exhibit diverse competitive strategies. MyAngelsEscorts.com employs a sophisticated freemium model, combining claims of "lowest cost" advertising with premium paid promotional features (e.g., VIP status for 800% more views). This hybrid approach allows it to attract a large volume of providers while simultaneously generating substantial revenue by upselling enhanced visibility. Its comprehensive payment options further streamline the process for providers, addressing a common challenge in the adult industry.

EscortLocate.co.nz, in contrast, prioritizes market penetration by offering free listings for providers. While this strategy is effective for building a large database of services, it currently appears to under-monetize its core offering. The platform's emphasis on a "refined and easy" user experience, coupled with mandatory photo verification, aims to build trust and streamline service discovery. However, it could benefit from incorporating premium features for providers to diversify revenue streams.

Emerging platforms like Oni.nz represent a shift towards hybrid social media models, integrating listings with community features and "special requests." This indicates a growing demand for more interactive and personalized experiences beyond traditional directory functions. The industry-wide trend towards user-generated content and verification, while crucial for trust, also highlights the ongoing challenge of content moderation and platform liability.

In conclusion, the New Zealand adult escort directory market is dynamic, shaped by unique legal parameters and evolving user expectations. Success hinges on a delicate balance between regulatory compliance, effective digital marketing (especially SEO), robust trust-building mechanisms (like verification), and innovative monetization strategies that cater to both providers' need for visibility and clients' desire for discreet, efficient, and potentially more interactive service discovery. Platforms that can adapt to these evolving demands by enhancing their feature sets and diversifying their revenue models are best positioned for sustained growth and prominence.